ART MARKET

Art has established itself as an asset class in recent decades. Due to the uncertainties on the capital markets and against the background of a recommendable asset diversification, art remains a strong focus. Through the independent performance of traditional investments such as equities, bonds and real estate, the acquisition of art can ideally complement any well-structured portfolio.

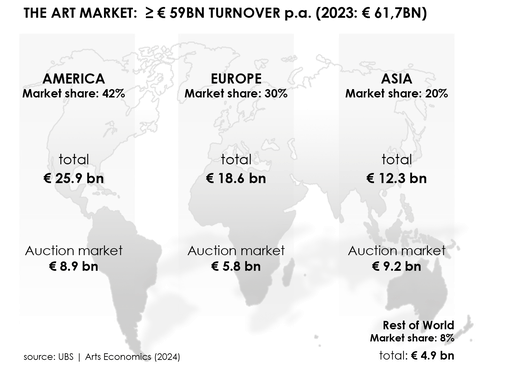

- Market volume: ≥ € 50 billion p.a.

- Rising numbers of visitors to museums, trade fairs (Art Basel / Paris Photo) & international art exhibitions

- Entry of financial institutions (UBS, Banque Pictet/Carlyle, Morgan Stanley/Blue Rider Group, etc.)

- Stable value over the centuries despite crises and wars

- Performance of art hardly correlates with financial markets

- Manageable low maintenance costs after the purchase of art

The art market: MARKET SHARE OF THE VARIOUS ART GENRES IN THE TOTAL MARKET

The art market is divided into genres with different market shares & dynamics. A well-founded analysis of the segments is essential for targeted asset

protection through art. With a market share of 55%, “Post War & Contemporary Art” dominates and offers the best buying & selling opportunities. Empirical data, such as the Deloitte

Art & Finance Report, show that this segment has the most consistent performance of the last 25 years with annual value growth of over 10.98%.

Fine Art Invest Group AG focuses on contemporary photography as an entry-level investment in this segment.

« Last year, CHF 51 billion was realized on the global art market.

7% more than in the previous year, 150% more than ten years ago, 600% more than in the early 1990s. »

Wirtschaftswoche