the art investment

Securing wealth through art

In addition to equities, real estate and financial assets, art has offered a meaningful opportunity for asset diversification for decades. Especially banks, insurance companies and wealthy clients have been using this effect for decades to further secure their assets. The Fine Art Invest Group enables you, from an amount of € 30,000 upwards, to become independent of fluctuations on the stock markets and monetary influences - through art.

UBS „Survey of Global Collecting“ – average share of art in the total portfolio of assets

The UBS study “Survey of Global Collecting 24” analyzed the activities and buying behavior of 3,660 high-net-worth individuals (HNWIs) who were active in the art market in 2023 and 2024. The results show that 50% of respondents invest 11% to 30% of their assets in art. In addition, 8% of participants secure 31% to 50% of their capital by investing in art, while 2% invest more than 50% of their assets in this form of investment.

Overall, 85% of respondents rate art as a safe and diversifying form of investment that is characterized by low dependence on market volatility and inflation.

Recommended share of art for asset protection

Based on the average proportion of art in the overall portfolio of professional investors and asset managers, Fine Art Invest Group AG recommends that private investors invest 15-20% of their total assets in art in order to secure their assets in the long term.

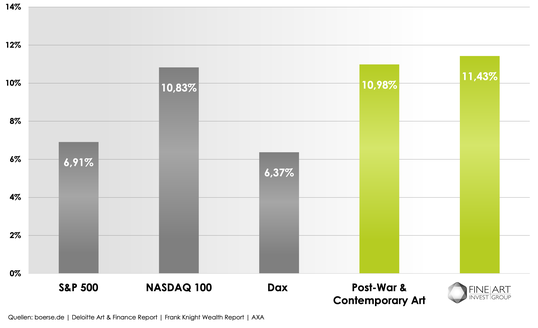

Art beats stock market values – ø Performance 2000 – 2023

Scarcely any other asset class has been able so sustainably multiply the capital invested. The value increase for artworks has been constant and even achieves an astounding profit, when other investment products suffer huge losses because of economic crises. The art market is growing and performing with over 10.98% growth per year for over 20 years, which has been proven (Deloitte Art & Finance Report). With its art management, FAIG AG once again exceeded this value and achieved an average performance of just under ø 11.43% since the year 2000.

« If you're looking for something consistent, you'd better invest in art. »

Alan Greenspan, frm. FED CEO